Wall Street Journal

U.S. Adds 74,000 Jobs as Hiring Slows Sharply

Unemployment Falls

to 6.7% Because of People Leaving Workforce

By

Jonathan House

Updated Jan. 10, 2014 10:56 a.m. ET

The U.S. job gap created during the most recent recession remains, and while

payrolls are being added to the economy, they haven't kept pace with population

growth.

WASHINGTON—U.S. job growth slowed sharply in December amid unusually cold

weather, closing out the year on a weak note and potentially dousing the Federal

Reserve's enthusiasm about the recovery as it winds down its bond-buying

program.

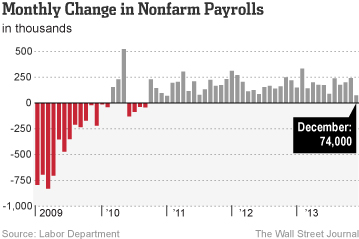

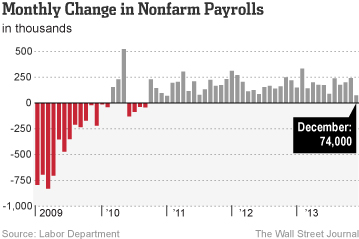

U.S. payrolls rose by 74,000 last month, the smallest monthly gain in three

years, the Labor Department said Friday. The figure marked a sudden pullback

from growth of 200,000 or more in the prior two months.

The Labor Department said the unemployment rate fell to 6.7% from 7%, though the

decline was largely the result of people leaving the workforce. Economists had

expected a gain of 200,000 jobs and a 7.0% jobless rate, according to a Dow

Jones Newswires survey.

The Labor Department data included signs that the hiring slowdown was at least

partly due to colder-than-usual weather last month, a factor that suggests the

December reading isn't necessarily the beginning of new downward trend.

The jobs report showed a 16,000 decline in December construction payrolls,

reversing most of the prior month's gain and ending a six-month string of gains.

The sector is particularly sensitive to weather conditions.

The number of people not reporting to work because of weather conditions was

273,000 in December, according to the survey of households. That was higher than

the average of 179,000 for the past 10 Decembers and the highest for that month

since 1977.

Morgan Stanley economist Ted Wieseman, using the Labor Department figures,

estimated that colder weather restrained payroll growth by 50,000 by 75,000

jobs. "Weather was an important contributor to the softness in December payroll

job growth but not enough to explain all of the softness," he said in a note to

clients.

The latest jobs data could give some Fed officials pause as they meet at the end

of the month to consider further cuts to their bond-buying program, which is

designed to keep interest rates low and boost the economy. Fed officials decided

last month to reduce the pace of monthly purchases by $10 billion this month to

$75 billion. They have signaled plans to reduce the pace by $10 billion

increments at subsequent meetings, provided the recovery in the job market and

overall economy remains on track.

"The Federal Reserve's justification for tapering its asset purchases—that

recent labor market progress was sustainable—appeared to be tested today," said

Paul Edelstein, economist at IHS Global Insight.

Weakness in December's report was broad-based, extending beyond

weather-sensitive sectors. Government payrolls declined by 13,000 in December.

The health-care sector, a steady growth driver for much of the year, declined by

1,000.

One bright spot: Retail employment rose by over 55,000, though the strength

highlighted that the jobs recovery has been largely skewed toward lower-paying

industries. Average hourly earnings rose 1.8% in December from a year earlier,

down from a 2% gain in November.

More than four years into the economic recovery, the job market's healing

process remains far from complete. The unemployment rate remains near levels

previously seen only during recessions. The share of Americans who are either

working or looking for work fell to 62.8% in December, returning to the 35-year

low it touched in October.

A

broader measure of unemployment that includes people working part time who want

full-time jobs and people who have who are marginally attached to the labor

force stood at 13.1% in December, unchanged from November.

Monthly payroll numbers can be volatile and subject to large revisions. The

numbers for October and November payroll numbers were revised up by a combined

38,000, bringing the average gain over the last three months to about 172,000.

That represents a small rise from a 167,000 monthly average between July and

September. For all of 2013, the average pace of monthly gains reached 182,000,

down slightly from 183,000 in 2012.

The December employment report showed a labor market struggling to accelerate

despite other evidence of an increasingly broad-based recovery. Recent data on

housing, manufacturing and consumer spending have shown mounting strength.

Better-than-expected trade figures earlier this week led many economists to

sharply raise their forecasts for economic growth in the final three months of

the year. Macroeconomic Advisers boosted its fourth-quarter projection to 3.5%

from 2.6%. Fourth-quarter growth at that pace, following a 4.1% annualized

increase in the third quarter, would mark the fastest half-year growth stretch

since the fourth quarter of 2011 and the first quarter of 2012.

Write to

Jonathan House at

jonathan.house@wsj.com

and Sarah Portlock at

sarah.portlock@wsj.com