ECON 272 - Notes on

Fiscal Policy and Keynesian

Economics

Most of these ideas come from John Maynard Keynes,

The General Theory of Employment, Interest and Money, 1936.

The basic point of Keynesian economics is that recessions and depressions can occur because of

inadequate

aggregate demand

for goods and services.

Overall basic ideas:

-

The

economy is demand (spending) driven. Say’s Law not correct –

economy is demand driven. Keynes said that Say's law did not hold up in the

"general case" - hence the title of his book;

-

The short run is the relevant time period to judge outcomes of markets and also to

judge the outcomes of government policies;

-

Markets

are chaotic if left on their own. They

are not able to "self-correct" because of

"sticky" wages and prices (it is costly to adjust

wages and prices so they do not always move with market changes).

-

The focus is to bring down unemployment through

counter-cyclical government policies.

-

Planners

have the knowledge and know-how necessary to “smooth out” the cycles of the economy by the

use of monetary and/or fiscal policy.

Keynesian Macro Policy

Keynesians want to stimulate aggregate

demand - since they believe that with more spending there will be more income -

and more hiring and less unemployment.

So, which policy is best:

monetary or fiscal?

Keynesians like both -- however, one

might be more effective than another depending upon circumstances.

Remember, fiscal policy is

usually recommended over monetary policy if interest rates are low - this is

because of a "liquidity" trap.

The

Simple Keynesian Model (Income-Expenditures Model or 45 degree Model)

Remember - to a Keynesian, the economy

is driven by aggregate demand -- or aggregate expenditures or consumption in the

economy.

The most important variables that determine the level of

aggregate consumption are:

-

Current disposable income:

-

Household wealth:

-

Expected future income:

-

The price level:

-

The interest rate:

Notice how income (current and expected) is very important.

In the simple Keynesian model, a

certain level of national income (Y) in the economy will correspond to a certain

level of expenditures in the economy -- which in turn corresponds to a certain

level of unemployment. Higher levels of AD and Y will decrease

unemployment.

All of the above will impact one or all of the four

components of aggregate demand.

AD

= C + I + G + Net Exports. If income is higher, for example, consumption

will be higher, etc.

Graphically, the Keynesian model adds up

the components of expenditures (AD) in the economy. Equilibrium is where

AD = AS (GDP).

C = Consumption function:

Autonomous expenditure or consumption:

What about savings - also a function of income. More later.

GRAPH:

I = Investment:

This is the most volatile component of

aggregate demand. It is what can create the deep cycles - a big drop in

aggregate demand, for example.

Keynes explanation then of a business

cycle was what he called "animal spirits" (basically a psychological

explanation for economic problems) -

Keynes used this term to talk about

the importance of confidence and the ‘gut instincts’ of

investors (and consumers too) regarding future business

ventures and investing generally. He said:

"Most, probably, of our

decisions to do something positive, the full

consequences of which will be drawn out over many

days to come, can only be taken as the result of

animal spirits – a spontaneous urge to action rather

than inaction, and not as the outcome of a weighted

average of quantitative benefits multiplied by

quantitative probabilities." The General Theory

of Employment, Interest and

Money.

So, for example, economic data

such as rates of return today may be inadequate in terms

of how business decisions are made. For example, rates

of return may be high, but, if businessmen fear a

recession then investment is likely to go down.

If people expect a recession, then

confidence in the future (or expectations of future

returns) will be low and saving will

increase.

What does 'Animal Spirits' mean

A term used by

John

Maynard Keynes used in one of his economics books. In his 1936

publication, "The General Theory of Employment, Interest and Money," the

term "animal spirits" is used to describe human emotion that drives consumer

confidence. According to Keynes, animal spirits also generate human trust.

BREAKING DOWN 'Animal Spirits'

There has been a resurgence of interest in the idea of

animal spirits in recent years. Several books and articles have been

published on this topic. Keynes believed that animal spirits were necessary

to motivate people to take positive action

Read more:

Animal Spirits Definition | Investopedia

http://www.investopedia.com/terms/a/animal-spirits.asp#ixzz4UBYSeaiw

Follow us:

Investopedia on Facebook

What does 'Animal Spirits' mean

A term used by

John

Maynard Keynes used in one of his economics books. In his 1936

publication, "The General Theory of Employment, Interest and Money," the

term "animal spirits" is used to describe human emotion that drives consumer

confidence. According to Keynes, animal spirits also generate human trust.

BREAKING DOWN 'Animal Spirits'

There has been a resurgence of interest in the idea of

animal spirits in recent years. Several books and articles have been

published on this topic. Keynes believed that animal spirits were necessary

to motivate people to take positive action.

Read more:

Animal Spirits Definition | Investopedia

http://www.investopedia.com/terms/a/animal-spirits.asp#ixzz4UBYHeYPF

Follow us:

Investopedia on Facebook

What does 'Animal Spirits' mean

A term used by

John

Maynard Keynes used in one of his economics books. In his 1936

publication, "The General Theory of Employment, Interest and Money," the

term "animal spirits" is used to describe human emotion that drives consumer

confidence. According to Keynes, animal spirits also generate human trust.

BREAKING DOWN 'Animal Spirits'

There has been a resurgence of interest in the idea of

animal spirits in recent years. Several books and articles have been

published on this topic. Keynes believed that animal spirits were necessary

to motivate people to take positive action.

Read more:

Animal Spirits Definition | Investopedia

http://www.investopedia.com/terms/a/animal-spirits.asp#ixzz4UBYHeYPF

Follow us:

Investopedia on Facebook

G = Government spending:

NX = Net Exports (the simple model does

not include net exports - but we could easily add them in):

Adding C + I + G + NX gives us AD

(aggregate demand) GRAPH:

Let's add a 45% line. What does

that mean?

Let's show a recession on the 45 degree

model (let's say animal spirits are alive and well and people are expecting bad

times - so they stop investing and consuming and start saving):

GRAPH:

In this situation, Keynes argued for

fiscal policy to boost demand and therefore, in the Keynesian model,

economic growth.

So let's be Keynesian economic planners.

What knowledge do we have to know in order to hit our target (YF) -

the income level that will lead to full employment.

First we have to know the model - which

includes these concepts:

The Keynesian Multiplier

Effect:

an increase in expenditure leads to a larger increase in income (Y) and real

GDP. Remember, Y = GDP in equilibrium.

A

change in C or I or G or NX will cause a multiple change in National Income (Y)

and real GDP.

This is the Keynesian multiplier effect.

Example: when C increases, Y

increases, which in turn will increase C & S, and then Y again, then C &

S again, and so on.

Depends upon

the Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS).

Marginal Propensity to Consume

(MPC):

Marginal Propensity to Save

(MPS):

MPC + MPS = 1. The higher

the MPC, the higher the multiplier effect.

So if G increases - income (Y) will

increase even more than G did! It's a miracle! GRAPH:

Remember -

Keynesian Goal

is full employment.

And to reach that, aggregate demand must increase. Remember what the

problem is: lack of aggregate demand.

So let's

return to saving. Saving is not good for the economy. Saving

means less spending.

Furthermore, when someone puts their

saving in the bank - it doesn't necessarily get back out in the economy through

loans or investments.

Savers and investors are two different

groups and are not linked.

S = f (Y)

I is a function of animal spirits.

So there's no reason that even when people put their money in the bank, people

will borrow and spend/invest it.

Furthermore, Keynesians talk about what

they call The Paradox of Thrift (or Savings):

As individuals save, aggregate demand

goes down - thereby causing income and employment to drop.

Therefore, as the economy becomes worse,

individuals are not able to save as much - since many of them have lost their

jobs!!

The paradox is that total savings may

fall even when individual savers attempt to save more. So basically, this

theory says that while individual savings might be good to the economy if it

leads to future investment in capital goods, etc., this paradox says that

"collective" savings may be bad for the economy.

So the Keynesian planners must

stimulate aggregate demand with fiscal policy. But what fiscal policy

in particular? What will lead to the greatest increase in aggregate demand

and economic growth?

What are the planners options?

1. Increase G but keep a balanced

budget. So increase in G must = increase in T.

2. Just cut taxes (don't increase

or decrease G) - the deficit gets larger.

3.

Most

powerful fiscal policy is to increase G but do not increase T (i.e. deficit

spend) in order to stimulate demand and therefore income and employment.

Why?

So Keynes recommended deficit spending

as a fiscal policy tool. He did not foresee the large deficits (and therefore

debt) that many countries have today. He thought - in good times when tax

revenue is high - pay down the debt. But in bad times -- stimulate the

economy through deficit spending in the short run.

DO ICE FIFTEEN

The Critics

of Government Deficit Spending

Total federal spending as a share of the total

economy (measured by GDP) - growing from 3% of the economic pie

prior to the New Deal, to over 20% of today's GDP.

https://fred.stlouisfed.org/series/FYONGDA188S

Let's look deeper into government deficit spending and the

government's debt. Remember - the U.S. federal government goes into debt

by issuing bonds.

The Debt Clock

As with any debt - we need to look at the debt

compared to the pie: so if we use GDP as our pie measure, how big is the

debt compared to GDP?

Debt as % of GDP

https://research.stlouisfed.org/fred2/series/GFDEGDQ188S

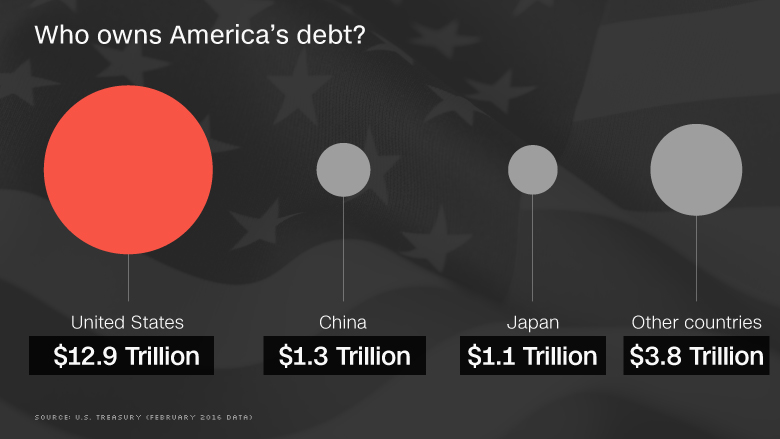

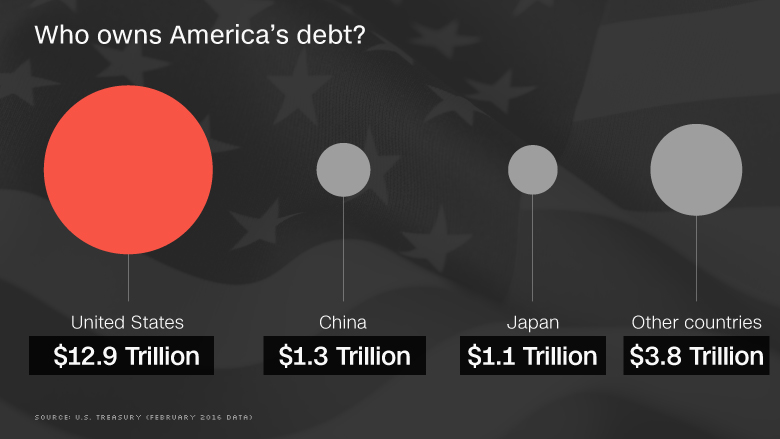

Who holds the U.S. government debt?

There are two basic categories of debt owners:

1) the

public, which includes foreign investors and domestic investors

and,

2) federal accounts, also known as "intragovernmental

holdings."

1. Debt Held by the Public: Domestic Investors

Public debt is also held domestically. Domestic

private investors - which includes regular American citizens as well as

institutions like private banks. Finally, U.S. state and local governments have

also lent money to the federal government. About 26.5%.

The U.S. Federal Reserve Bank buys and sells

Treasury bonds as part of its work to control the money supply and set

interest rates in the U.S. economy. About 13%.

Debt Held by the Public: Foreign Investors

The U.S. debt is also held

internationally by foreign investors (i.e. foreign governments,

foreign institutions, and individual people in foreign countries)

who buy U.S. Treasury bonds as investments. About 32.5%.

2. Debt Held by Federal Accounts

Debt held by federal accounts is not considered

public debt - it is the amount of money that the Treasury has borrowed

from itself. That may sound funny, but it means that the Treasury

borrows surplus money from one trust fund and gives it to another trust

fund. For example, the Treasury might borrow money from Social

Security to finance current government spending in another area. At a

later date, the government must pay that borrowed money back.

About 28%.

My source:

http://money.cnn.com/2016/05/10/news/economy/us-debt-ownership/

The

Criticisms

There are many critics of the idea that

deficit spending should be used to "stimulate" the economy. Obviously,

those who follow Say's Law do not believe that stimulating demand (in any way)

is the answer. But there are more specific criticisms. Here are a

couple.

1. Keynes was and Keynesians

still are naive to believe that deficit spending doesn't lead to more and more

debt over time - a political argument - James Buchanan.

a. First of all - is it moral?

Passing the debt burden to future

generations (is this moral?)

Future Taxes: deficit spending today and

interest payments mean that future generations will pay more of their tax

dollars to the government's creditors and less for other things. Remember,

when the government spends - the private sector can't.

b.

He said that what Keynesian economics did

(by making deficit spending acceptable as a policy tool for the government) was change the

"cultural norm" of the government (which was to keep a balanced budget

except in perhaps war time). This change in the norm has lead to very

large deficits and a very large debt. It "opened the door" for politicians to use deficits for

political reasons. Remember, it was not that Keynes himself

said we should run large deficits all of the time -- but what Buchanan said was

that Keynes was naive of the political consequences of this policy.

Politicians like deficits and therefore many governments end up with very large

debts. Why?

How might the government debt be paid? "Public Choice

argument" -

2.

Opportunity cost -- when someone lends

money to the government (buys a treasury bond), they are moving resources from

the private sector to the government sector.

When people buy a government bond instead of a corporate bond, for example --

there's less private investment. So there is an opportunity

cost as to the use of those resources (Bastiat's unseen again).

Will the government be as

"productive" with the resources as the private sector would be?

That is the question. This is often the political debate we see in

Washington, D. C.

3. Crowding out -- government borrowing

reduces private spending by raising interest rates (theory regarding why a

large government debt, or prolonged deficit spending, is anti-productive).

Those who believe that productivity drives the

economy criticize deficit spending for potentially decreasing productivity

through crowding out.

CROWDING

OUT

As with any model - we must first look at the assumptions

being made. The model is of the loanable funds market.

Savings = f (interest rate)

Investment = f (interest rate)

There are savers - who supply loanable funds.

There are investors - who demand loanable funds (they want to

borrow).

So the loanable funds market:

Savings =

supply of loanable funds.

Investment =

demand for loanable funds.

GRAPH

When G > T (the government

deficit spends and goes into debt). It enters the loanable funds market

and bids for investment funds. This

increase in the demand for loanable funds drives interest rates up and this “crowds out” some private investment

(demand for funds by private investment goes down because of the higher cost of

borrowing).

So why anti productive?

Private investment is productive investment (in capital goods).

Government spending is mainly on "consumer goods" (non

productive spending). The government has

moved resources from the productive to the unproductive sector of the economy.

Keynesian Counter:

Infrastructure argument.

Counter

to this Counter: Private

firms can produce infrastructure and there's no guarantee that the government

will spend money on infrastructure.

DO ICE SIXTEEN