Lecture Eight: The Size and Growth of Government - Evidence and Theory

Sources: Thomas Garrett and Russell Rhine, "On the Size and Growth of Government," Federal Reserve Bank of St. Louis Review, Jan/Feb 2006 (GR); Tullock, Baumol, Ferris and West, Mueller, Niskanan, von Mises, Meltzer and Richard, Kristov, Lindert, and McClelland, Peltzman, Buchan, Brennan, Breton, etc.)

What has government done?

http://www.whitehouse.gov/omb/budget/historicals

Data shows that the size of the federal government in the U.S. has grown dramatically.

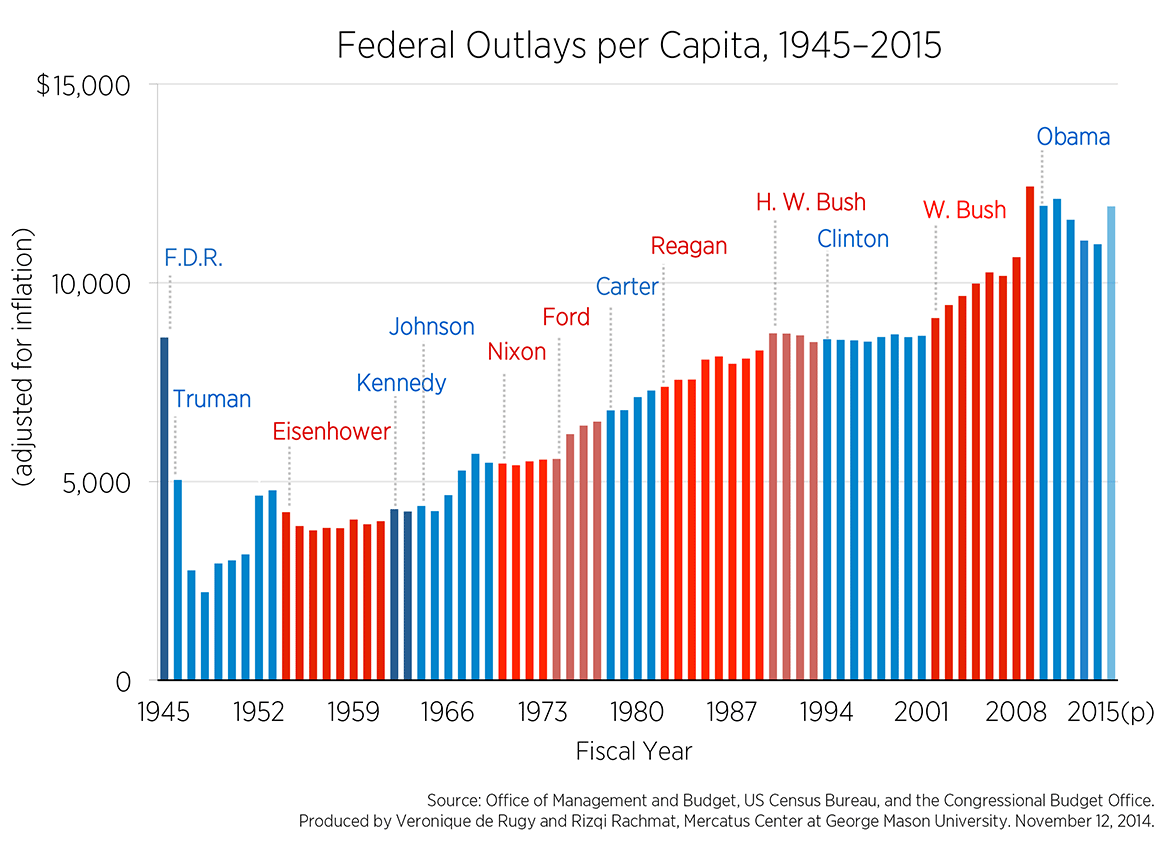

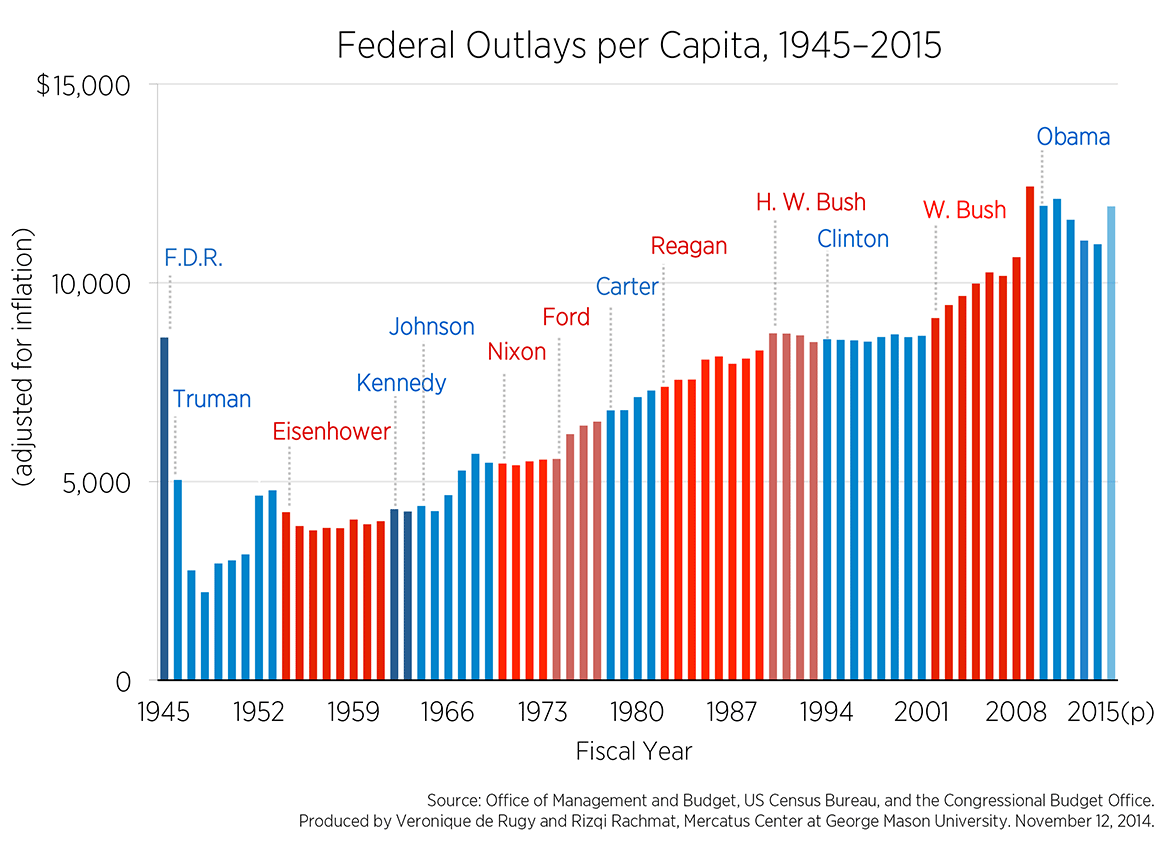

Another measure of the size of government (probably most popular) is federal expenditures per capita.

In the 20th century the growth in federal government was due to an increase in the physical size of government (number of agencies, functions, etc.) as well as an increase in spending by existing government agencies.

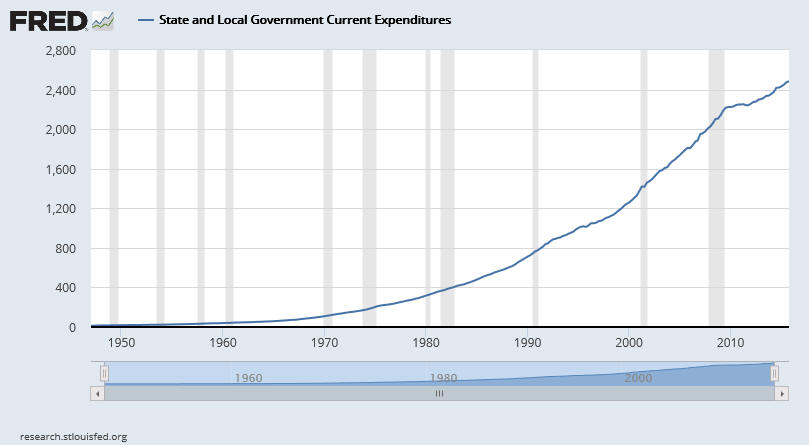

State and local government spending has also increased.

Why has this happened?

Theories of government size and growth fall into two categories:

Citizen-Over-State (Demand): Citizens demand more government.

State-Over-Citizen (Supply): The public sector supplies more government independent from demand due to inherent inefficiencies in the public sector activities.

Let's look at the demand side first:

Citizen-Over-State Theories of Government Size and Growth

Government as Provider of Goods and a Reducer of Externalities

1. What is the price and price elasticity of demand for government?

Looking at our old friend the Median Voter Theory:

Assumptions:

a. two-party system (conservative vs. liberal),

b. majority rules,

c. citizens vote directly on government spending issues,

d. government spending is the only issue on the ballot.

Conclusion: So the median voter (where most voters fall) determines the demand for publicly provided goods.

Median Voter Demand function for Government = f (income, relative price of public goods to private goods, tastes)

The price elasticity of demand for government (how responsive voters are to a change in the price of government) and the price of government are both determinants in the size and growth of government.

The literature (mostly Baumol) presents evidence that the price of government relative to the private sector prices is increasing and yet the size is growing -- so this theory would say then that the demand is inelastic.

Another theory - Ferris and West - wages in the public sector are increasing faster than in the private sector (adding to the increase in the price of government). Public unions contribute to this.

The "literature" also finds that the taste and preferences of voters have changed -- especially an increase in the demand for insurance programs provided by the government. People are more risk averse and want the government to provide safety nets? What do you think?

Also, after 9-11, do you think the demand for military spending has increased? Homeland security? Etc.

The Government as a Redistributor of Income and Wealth

2. Lower income voters will vote for high subsidies and high tax rates:

The model (Meltzer and Richard):

Increase productivity → increase income → increase consumption and well-being.

Individuals will demand the combination of tax rates and lump sum payments that maximizes their well-being.

Conclusions: individuals with a lower level of productivity and income will demand a higher tax rate and a higher lump-sum payment from the government.

Extreme case -- Bob, who doesn't work or pay taxes, will want the maximum payment from the government and a very high tax rate.

So how does this explain the growth in government?

Over time, new entrants into the voting population are lower income workers. These lower income workers will cast votes for the candidate who will levy higher taxes and increase the amount of redistribution.

3. Social Affinity:

The model (Kristov, Lindert, and McClelland):

Assumptions:

a. The closer the middle class feels to the poor - the more they will vote to give the poor money.

b. The slower incomes are growing - the more they will vote for government transfer programs.

Conclusion: More redistribution of wealth via government and the size of government grows.

4. Political Candidates Gain Votes by Offering Transfer Payments

The model (Pelzman):

Assumptions:

a. Voters will vote for candidates that offer them transfer payments

b. If the distribution of incomes is similar -- the candidate must offer a greater amount of redistribution to gain support

Conclusion: Candidates offer more and more transfer payments to get votes and the size of government grows.

5. Interest Groups:

The model (Olson):

Assumptions/Definitions:

a. Interest group - organized collection of individual voters (or businesses) having the same preference for a specific policy.

Theory: by lobbying (promising big votes, etc.), the interest group can obtain policy that has direct benefits for the interest group but the costs of the policy are spread across millions of taxpayers.

Conclusion: Therefore, policies are passed that benefit a few at the expense of the many. Considered inefficient (societal costs greater than societal benefits) -- and increases the size of government in order to implement the policies.

As we have seen logrolling contributes to this.

Other Interest Group Issues:

Causality Issue: Does interest group activity cause government spending, or do changes in the level of government spending influence interest group activity?

Is the interest group theory really a citizen-over-state theory -- or a state-over-citizen theory -- given that elected officials play a large role in the process.

State-Over-Citizen Theories of Government Size and Growth

Premise: The incentives facing public officials and the nature of our representative form of government provide an environment for government growth to occur in the absence of citizen demand.

1. Bureaucracy Theory (Niskanen)

Assumptions:

The model: Bureaucrat's utility function = f (desire for salary, prestige, power, etc.) and there's a monitoring problem.

Conclusions:

1. Bureaucrats can generate budgets that are in excess of what citizen demand warrants and beyond the efficient level.

2. The costs of government organizations compared to private organizations that provide similar services are typically higher.

2. Fiscal Illusion (Buchanan's version):

Assumptions:

1. Government, specifically legislators and the executive branch, can deceive voters as to the true size of government.

2. Citizens measure the size of government by the quantity of taxes they pay.

The Model: Some taxes and tax collection measures are less obvious to citizens than others - and are more likely to be used by government.

Examples: federal withholding of income taxes and property tax collection through monthly mortgage payments.

Conclusion: People are fooled into believing that the government is smaller than it actually is (due to hidden taxes) and are more likely to vote for even more government and more taxes.

Direct Tax: tax paid to the government by the person on which the tax was imposed or levied.

Indirect Tax: tax paid to the government by a second party - other than by the person on which the tax was imposed or levied.

It might seem that indirect taxes would create more fiscal illusion -- but that is not so. The federal income tax is a direct tax -- and because of how it is paid, it is often "hidden" to many taxpayers.

Which taxes are "hidden" from taxpayers is an empirical issue.

Overview of the literature (Oates) and five hypotheses regarding fiscal illusion:

1. tax burdens are more difficult to evaluate when the tax structure is more complicated,

2. progressive tax structures that increase a citizen's tax bill according to income increases are less obvious than legislated changes to the tax code (so increases in the % paid by the legislature is easier than changing to a different tax system) - taxes go up and people don't notice it as much.

3. home-owners are better able to judge their portion of property taxes than are renters - renters are likely to vote for more property taxes (not knowing they are paying them)!

4. the issuance of debt (and thus the likelihood of future tax increases) appears less costly to voters than current tax increases,

Problem: Does fiscal illusion really explain the size of government? You might want to incorporate this into your project: Example - change the way the government taxes might lead to less fiscal illusion -- and therefore this theory can back up your decision to change the tax structure.

3. Monopoly Government (Bundling) (Breton, Tullock):

Model: Representative governments behave as monopolies (certain things that people can only obtain from the government - these are increasing as we speak)!! This "forces" people to obtain things from the government, when otherwise they would obtain them from the private sector.

The Utility of the People who are members of the Party in Control of Legislator = f (probability for reelection, personal pecuniary gain, pursuit of personal ideals)

Theory - bundling non-monopolized goods with a monopolized. Consumers will then buy both as long as it is worth it to them.

In the case of government - this bundling of services results in higher levels of government output.

4. Logrolling (vote trading among legislators) (Tullock):

We know about this:

5. Leviathan Government (Brennan and Buchanan):

Model: government's sole objective is to maximize revenue.

Assumptions:

1. Citizens have lost all control over their government - and have given up!!

2. political competition is seen as an ineffective constraint on the growth of government

Instead of assuming that government is a benevolent supplier of goods, a reducer of externalities and a re-distributor of income - they assume that those in government act in their own self interest -- which is most always to maximize the size of their revenue.

Conclusion: Only constitutional constraints on the government's authority to tax and issue debt can limit a leviathan government. Or maybe a revolution!!!

For example, we will discuss the debt later -- but what about a constitutional amendment for a balanced budget? Would it work? Would an amendment limit spending be better at limiting the size of government? Why or why not?

A Note on the 16th Amendment to the U.S. Constitution

Prior to the 16th amendment in 1913 - the federal government was constrained from directly taxing personal income. Income tax collection had to be in apportionment to population. Could not increase the amount taken in from income tax without an increase in population.

After the 16th amendment - negated the apportionment clause. Population was no longer linked to the income tax.

Interesting: the size of government increased dramatically after the 16th amendment was ratified.

Furthermore, the government's reliance on federal income taxes over the past 90 years has increased -- as have expenditures.

http://www.whitehouse.gov/omb/budget/Historicals/

Few people paid income tax in 1913 -- if they paid, the rates were much lower than today. In October (1913), Congress passed the income tax law with rates beginning at 1 percent and rising to 7 percent for taxpayers with income in excess of $500,000. Less than 1 percent of the population paid income tax at the time.

Note, the withholding tax on wages was introduced in 1943 and was instrumental in increasing the number of taxpayers to 60 million and tax collections to $43 billion by 1945.